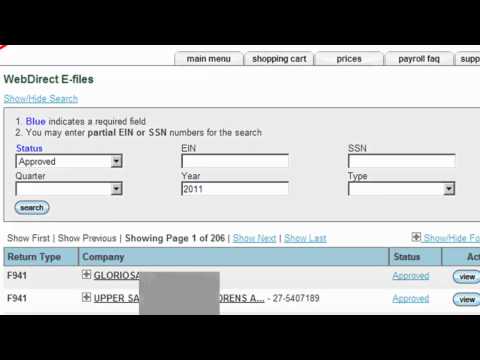

CNS Technologies. Over the years, Esmart Payroll has been an IRS authorized 941 and 940 payroll forms efile service provider since 2000. Payroll professionals can easily submit 941 forms in batch to the IRS electronically through Esmart Payroll. Users can check the status of their paper check evaluations, print 941 forms, revise and resubmit if necessary. The 941 data is generated from your payroll software in a txt format. Each 941 starts from the 941 container line to the sign here line, or includes schedule P monthly information. We can assist you with the data file format if you are interested. You need to have an account at Esmart Payroll to access these services. Once logged in, select the 914 941 tab in the main menu page. You will see different ways to prepare and submit 941, 940, and PIN applications. Choose "upload 941 in da txt" for multiple forms. Select the text year and choose a smartphone format (not XML), then browse to the data file. As shown on the left-hand side, it only takes three simple steps to upload any batch of 9.1. Our system will show the contents of your file for verification. Important company year, quarter, and amount information will be listed for your review. If everything looks fine, you can continue to complete the upload. After submitting the batch data, you will be able to check the e-file status for each 941 form in your account. You can search individual records based on different parameters and click the plus sign to see more details. The status could be submitted, processing, approved, or rejected. You can also print individual 941 copies. If a form is rejected by the IRS, you can click the plus sign to see the details of the rejection. From there, you can...

Award-winning PDF software

941 e file software Form: What You Should Know

Online Tax filing for Form 940, 1099, W2 & MISC. What is the e-file of Form? IRS e-file 2025 Form 941 — serve IRS Taxpayer Advocate website — The IRS Taxpayer Advocate website offers tax filing advice, answers to your questions and solutions to your issues. IRS e-file 2025 Form — eServe IRS Taxpayer Advocate website provides free tax advice in English and Spanish, answers to your questions and solutions to your issues. 2018 e-File — Form 941-EZ 2018 Form 941EZ is the only e-file 2025 for 2025 e-file — Federal Tax forms. New Form 941 EZ 2025 also allows filing of Form 941-A for Individual Taxpayers and Form 941-J for Joint Taxpayers. 2018 e-file serve IRS e-file 2025 Form 941 — eServe 2018 e-file with service allows Form 941 – 2025 to Form e-File — Individual Taxpayers and Joint Taxpayers as well. 2018 e-file w2 serve IRS e-file 2025 Form 941 — w2 serve 2018 e-file for Form 1099 — EZ. Form 1099-EZ 2025 e-file — Individual Taxpayers and Joint Taxpayers. 2018 Form 941 EAS serve IRS e-file for Individual Taxpayers — 2018. 2018 e-File Forms w2 serve — 2018. IRS e-file with service 2025 for Individual Taxpayers — 2018. 2018 e-file w2 serve — 2018. 2018 e-File Forms w2 eServe — 2018. Form 941 EAS will be issued during 2019, 2025 and 2019, respectively. The IRS will continue to accept and process EAS until end of calendar year 2018, for those individuals seeking e-file for 2025 tax year. For more information visit IRS e-file 2018 e-file — 2017 2018 e-file — Individual Taxpayers — 2018. 2025 e-file — EZ. Form941-EZ 2025 e-file — Individual Taxpayers and Joint Taxpayers. IRS E-file 2025 — Form 941 Form 941 EAS 2025 will be issued during 2025 through 2019, for Individuals filing 2025 tax year.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Irs 941 2016, steer clear of blunders along with furnish it in a timely manner:

How to complete any Irs 941 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Irs 941 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Irs 941 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 941 e file software